Even minor credit report inaccuracies can cost you money every day.

Have you ever calculated the cost of BAD CREDIT?

Do you know how much you have paid in additional fees due to your poor credit rating?

One conservative estimate is that a lower credit score costs the average consumer $4,500-$6,000 per year and over $75,000 or more in a lifetime due to extra charges that are assessed simply because of a low credit score. Unnecessary deposits, excessive interest rates, higher insurance rates, and lower-paying jobs are just a few of the financial hardships faced by those with problematic credit.

Below are areas that can be affected by having bad credit:

Automobile Financing

If you are financing a car and have bad credit, you are probably paying thousands of dollars more than you would pay with your credit restored. The additional thousands of dollars show up as higher interest rates and dramatically higher monthly payments. One of the first things that our clients often do once they have restored their credit is to refinance their automobile for a fraction of their current payment or buy twice the car at nearly the same payment.

Home Mortgage

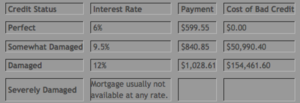

The “American Dream” of owning your own home is out of reach for most people with credit problems. As you will see below, even mildly damaged credit will cost a small fortune in additional interest. These higher costs may put limitations on the home you can afford causing you to purchase a home in a less desirable neighborhood, or to rent and pay off someone else’s mortgage for them.

Restoring your credit allows you the opportunity to purchase your own home at an interest rate and monthly payment you can afford while saving thousands of dollars in high-interest payments. Take a look at the table below:

$100,000.00 Home Loan paid over 30 years

Insurance

Most insurance companies use, what is called, a credit-based insurance score as just one part of the equation for determining your auto insurance, homeowner insurance rates for your home and auto. In short, the better your credit score the better opportunity you have of getting better insurance rates, of course there are the other determining factors as well.

Inaccuracies in Credit Reporting – Research conducted by PIRG (Public Information Research Group), Washington, D.C.

-

Twenty-nine percent (29%) of credit reports contain serious errors, false delinquencies, or accounts that did not belong to the consumer.

-

Forty-one percent (41%) of credit reports contain demographic information that was misspelled, outdated, or incorrect.

-

Twenty percent (20%) of credit reports were missing major credit, loan, mortgage or other information to demonstrate the creditworthiness of the consumer.

-

Twenty-six percent (26%) of credit reports contain accounts that were closed by the consumer but incorrectly listed as open (or) “closed by credit grantor”.

-

Altogether, seventy percent (70%) of credit reports contain errors or mistakes.

US Fair Credit Alliance – A Trustworthy Resource

We have one goal, to get your credit report accurate and verified as fast as possible, and at the lowest cost possible. If you believe information is inaccurate, we take a pro-active strategy with the credit bureau(s) and reporting companies forcing them to prove the information they are reporting is accurate, current, and verifiable according to state and federal law. If they cannot, then the reporting information must be removed. EVENTUALLY, WE PIERCE VIRTUALLY EVERY INACCURATELY REPORTED ACCOUNT AND THEY ARE REMOVED FROM THE CREDIT PROFILE.

Credit Bureaus spend millions of dollars to convince you that you have no legal options to remove bad credit from your credit reports, WHICH IS SIMPLY NOT TRUE! State and Federal Governments have enacted laws that give each consumer the right to challenge the accuracy, timeliness and validity of the information reported in their credit report. You can do this yourself if you know what to do and have the time to do it, or you can have US FCA provide this service to you at a very fair cost.

Let us prove our capabilities to you. Call (888) 212-1415 to speak to a Credit Specialist for your No-Obligation Consultation. We will openly answer your questions and help you determine if our program is the right solution for you. We believe in full disclosure and have nothing to hide. You will discover that our fees are very reasonable and our service is straight-forward. There is No-Obligation and we are happy to answer your questions.

What you receive with our program:

- Fast and Affordable Credit Repair Service

- Credit Optimization to help you achieve your creditworthiness goals

Call (888) 212-1415 to speak to a Credit Specialist for your No-Obligation Consultation. We will openly answer your questions and help you determine if our program is the right solution for you. We believe in full disclosure and have nothing to hide. You will discover that our fees are very reasonable and our service is straightforward. There is No-Obligation and we are happy to answer your questions.

You Are Not Alone …

It’s sad but very true that a large percentage of Americans suffer from blemishes on their credit report. A single blemish may prevent you from obtaining credit. Bad credit is embarrassing, humiliating, and depressing. Most people with bad credit are not “deadbeats” nor are they unwilling to pay their obligations. In fact, most of our clients, maintained good credit until some unforeseen circumstance like a layoff, medical problem, or divorce prevented them from making payments in a timely manner.

By knowing and exercising your legal rights US Fair Credit Alliance will assist you in taking the necessary steps to regain your good credit and rebuilding your financial independence and freedom.

Put an end to your credit problems…if it costs MORE TO KEEP BAD CREDIT THAN TO RESTORE YOUR CREDIT STANDING, why would you want to pay MORE to have so much LESS? DON’T WAIT! Procrastination is your worst enemy. Each day your credit score remains low it costs you more money.

Call (888) 212-1415 to speak to a Credit Specialist for your No-Obligation Consultation. We will openly answer your questions and help you determine if our program is the right solution for you. We believe in full disclosure and have nothing to hide. You will discover that our fees are very reasonable and our service is straightforward. There is No-Obligation and we are happy to answer your questions.